2014 University of Illinois Federal Tax Workbook: Volume A: Update & Ethics: University of Illinois Tax School: 9780983428787: Amazon.com: Books

I have a monthly wage of $1,000, but need to pay tax at $220, so I just have $780 in the end. Is this kind of tax rate common in Illinois? - Quora

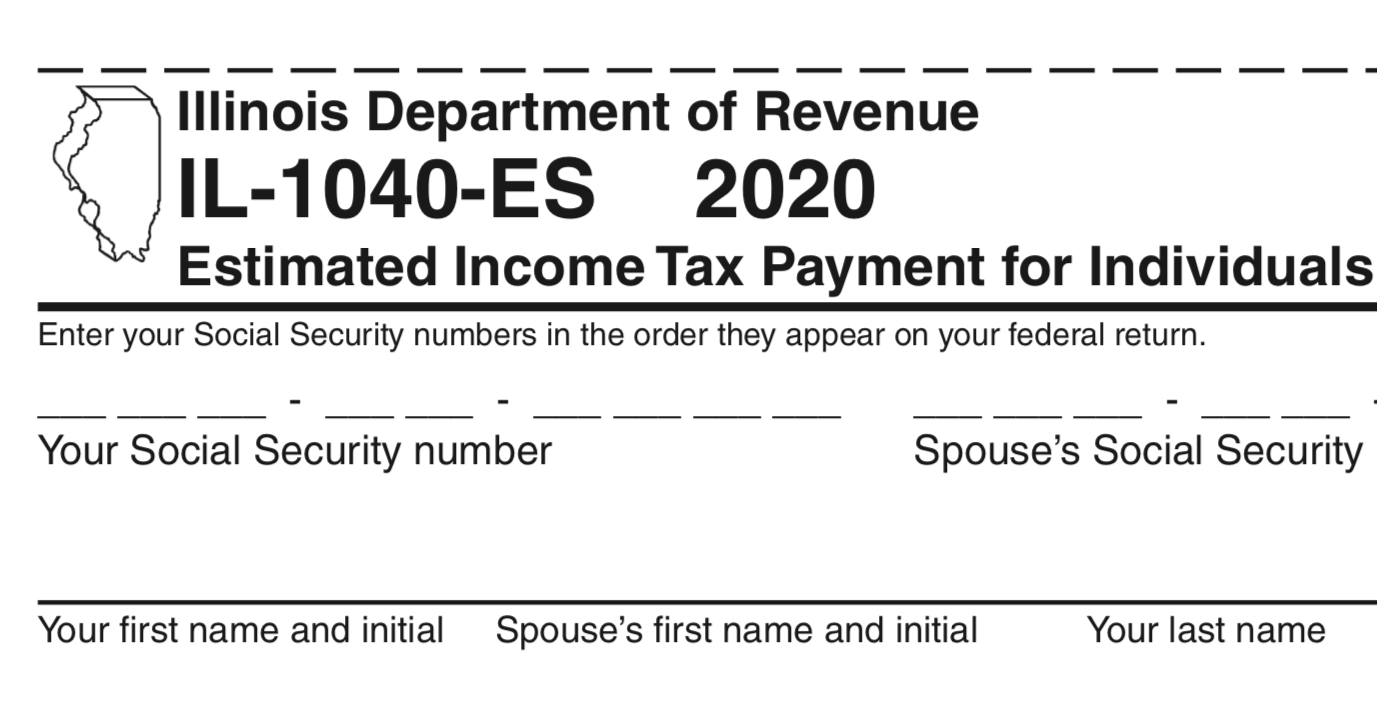

The Caucus Blog of the Illinois House Republicans: Calculating estimated state taxes during COVID-19 pandemic

Mega Millions on Twitter: "The taxes someone in Illinois will pay on the $1.28 Billion Mega Millions Jackpot prize General Illinois income tax of 4.95% Federal tax of 24% If winner is

Illinois Estate Tax-Relationship to Federal Estate, Gift and GST Taxes, as well as The Relationship Between Forms 709, 706 and 1041 | Illinois Institute for Continuing Legal Education - IICLE